FAQ - Child Plans

Q.

What makes child Insurance plan so unique?

Ans

A Child Plan is an Insurance Cum Investment Plan that serves two purposes:-

- Financial Security to your Child's Future

- Financing the turning points in your child's life like higher education or marriage.

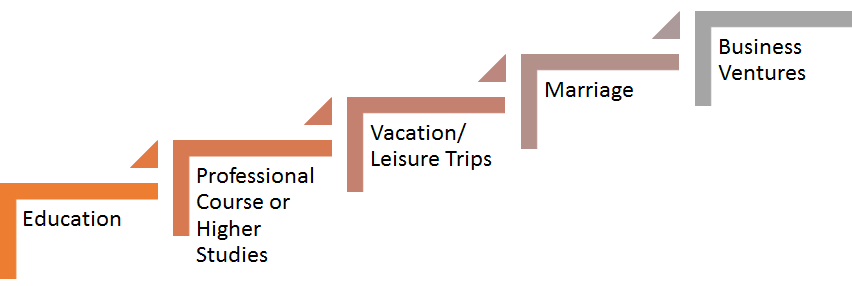

Setting a Financial Goal helps the insured to secure his child's future at every stage. Let us look at certain dreams your child may look forward to:-

The thumb rule says that while investing in a child plan, the life insured should be the parent and the child should be the beneficiary who will receive a compensation in the event of the death of the policyholder or at the time of maturity. One of the unique features of a child plan is that policy doesn’t lapse the policy continues for life and the pending premiums are paid by the insurance company.

Let us look at certain Benefits that offered under a Child Plan:-

- Maturity Benefits to meet Higher Studies Expenses

- Accumulate a Corpus/ Funds that will help in realising all dreams and avoid any hurdles to fulfil it.

- Option to Choose Riders: Certain Plans offer a waiver of premium (i.e. the entire premium will be paid by the insurance company) in the event the policyholder dies. Similarly, there are certain riders like - Personal Accident Benefit (Death & Disablement)

- Dynamic Fund Allocation Investment Strategy helps to safeguard your funds from Capital Erosion. It offers the customer to select the fund and STP (Systematic Transfer Plan) to plan the investments as per the expected returns required during different life stages of the child.

- Partial Withdrawals - There are certain plans that offer periodic payouts that will be useful to meet certain unknown expenses incurred while enhancing your child's future talent.

- Helps the insured to fulfil their financial commitments towards your child's dream.

- Income Tax Benefit for the Policy Holder - Policyholders can claim deductions under Section 80C of Income Tax Act. Tax exemptions are also available under Section 10 (10D) of the Income Tax Act, for the interests earned on the investment, in case the premium paid in any year does not exceed one-tenth of the basic sum assured. Funds disbursed. In the event of the death of the applicant are fully exempted from taxes.

If you would like to know more about the product please click here.