OneInsure Blog

Artificial Intelligence to Approve Claims in Minutes

Artificial Intelligence (AI) has come a long way from the days when it was barely able to beat the best human chess player of the time – Garry Kasparov. Applied AI is smoothening customer experience in many industries today and is destined to become a fit replacement for a human taskforce that deals with mundane and repetitive work.

The wave of implementation of AI is expected to bring futuristic quickness to almost any process that requires recognizing, memorizing, and analysis. And, insurance is already seeing a few developments of its own that every policyholder will soon benefit from.

What is Artificial Intelligence and Is It Already around Us?

You can experience the cleverness of AI in many online tools. Google’s Translate uses a unique machine-translation system to provide the most accurate translation between any two languages. One more commonly used AI function is the personal recommendations on the e-retail site amazon.com. Simple analysis and memory of the AI make it possible for the online site to predict the preferences of a buyer. Because of AI, the retailer’s business has increased threefold.

The mentioned tools are simple and outdated technological wonders. There are many more evolving examples of how AI is alive and kicking in our daily lives.

Insurance and Artificial Intelligence

A huge majority of insurance companies that offer their services online have an AI chat bot to offer easy solutions to customers. These solutions come from predicting queries and offering solutions based on geographical and social data. Basically, interactions are personalized to suit individual customers efficiently. Increasingly, insurance companies in India are involving AI in their taskforces for much more. Read on:

- Behavioral Policy Pricing: Sensors that monitor driving and health will provide personalized data to companies for appropriate pricing. This means good, safe drivers can pay lesser for auto insurance and people with healthier lifestyles can pay lesser for health insurance.

Suggested Reading:

- Telematics – A New Initiative by IRDAI to Reduce Motor Insurance Premiums

- Achieving Your New Year Health Resolutions Just Got Easier!

- Faster, Customized Claims Settlement: AI can now recognize the amount of damage done to your car. This feature has made renewals of car insurance easier, as uploaded photos of a car could suffice instead of the traditional physical inspections. By now, a lot of companies have completely eliminated human intervention for renewals. The next version of this facility will follow the same module and allow car accident claims to be passed in minutes, based only on photos clicked by car owners.

Insurance Apps are the Present and the Future for Fast Claim Approvals

As the environment for insurance is changing technologically, Indians are still not fully welcoming these advancements. 55% of policy buyers are still dependent on brokers, and why not, as the industry's insurance claim process is still complicated with both excessive jargon and way too many formalities.

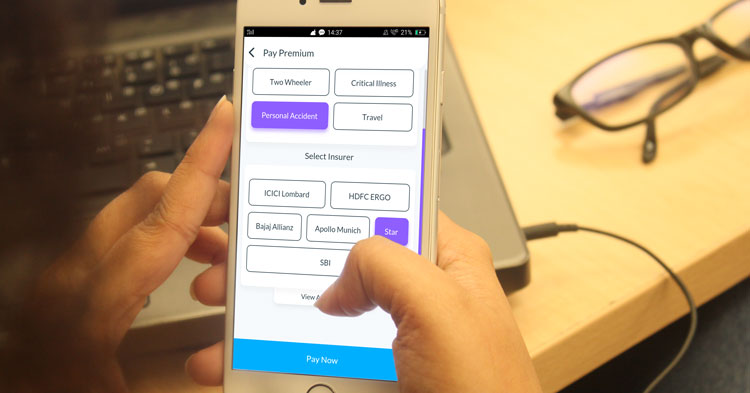

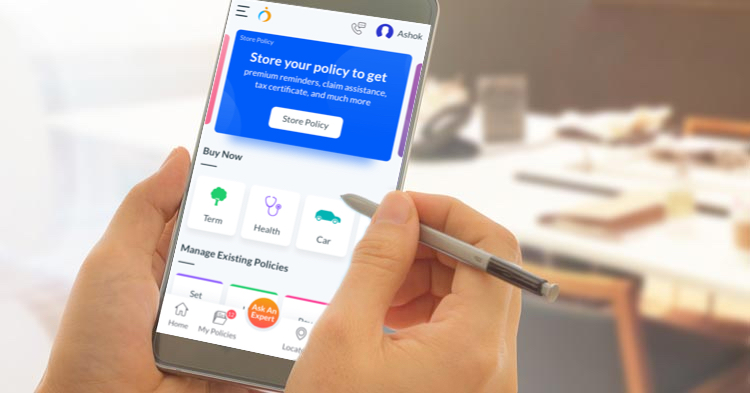

The ultimate goal being quick solutions, the alternative of telephonic assistance for customers is a big factor in making sure policies are purchased and claims are passed with no errors. Furthermore, an insurance policy-management app is currently behind making purchases faster and grievance solving much faster.

The OneInsure app has a number of features for quick services for ANY policy you own, irrespective of the company it has been purchased from. It recognizes the insurance provider of your policy and offers unique features, quickest methods to get your purchase, query, claim, or issue settled. All of this with a few clickable buttons, and the option to connect to our customer service executives instantly.

Undeniably, Artificial Intelligence will play a huge role in bringing an end to all unnecessary and redundant efforts, but that change is yet to become an integral part of the insurance business. Till then, policy-management apps are the most advanced way to keep the broker away to save on money as well as time.

Comments

Comments

Artificial Intelligence, Policy Management App

Artificial Intelligence, Policy Management App