OneInsure Blog

Celebrating Insurance Awareness Day – History of Insurance Part I

Insurance dates back several millennia. In precise terms, it was when trade across various continents through sea routes became a norm that people realized the need for insurance.

In this article, in the lead up to Insurance Awareness Day, we would like to take you back to where it all began. So, without further ado, let’s begin.

The Chinese and the Babylonians

Trade along sea routes became quite popular among Chinese merchants in the 7th and 8th centuries BCE when they travelled to and from the Middle East with precious goods for trade. However, there was always the danger of the vessels capsizing or falling prey to some other misadventure while travelling through the perilous waters, which resulted in heavy losses. As a solution, the Chinese merchants started distributing their goods among different vessels before embarking on their voyage so that one individual merchant would not suffer the whole of the loss but it got distributed among them all if at all a ship’s contents were lost.

Next were the Babylonian merchants, who developed another system to curtail their losses. Merchants that received a loan from a lender to fund his shipment would pay him an additional amount in exchange for a guarantee from the lender that he will cancel the loan in case the shipment gets lost or stolen while in transit. Does this additional amount paid to the lender against a guarantee received ring a bell? Today, this amount is referred to as the premium paid against the coverage offered under an insurance policy.

Moving on, the people of Rhodes deployed yet another method to reduce their losses at sea. This method comes quite close to the working of the modern-day insurance. Under this method, merchants whose goods were shipped together paid a certain amount (call it premium) to secure their goods. Now, the merchants whose goods were jettisoned due to storm or sinkage while in transit would be compensated out of the total premium collected.

The Great Fire of London

It was the Great Fire of London (1666) that made insurance a matter of great urgency. About 13,000 houses were devastated as a result of the wild fire that swept through the central parts of the city from Sept 2 to 6. Sir Christopher Wren—the architect who presented plans to rebuild London to King Charles II—suggested setting up an insurance office to safeguard the livelihoods of key people in the country. However, it was in 1681 that the first fire insurance company was established by the economist Nicholas Barbon with the help of eleven other associates. About 5,000 homes were insured with this company.

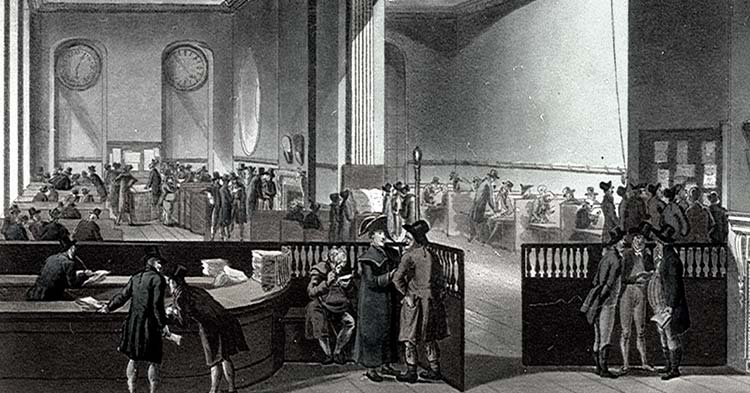

Towards the end of the same decade, with the increasing need of marine insurance, Edward Lloyd set up a coffee house that became a gathering place for shippers who wished to insure their ships and goods. This eventually led to the establishment of Lloyd’s – the famous insurance market place in London.

Comments

Comments

A brief history of Insurance, Insurance Industry

A brief history of Insurance, Insurance Industry