OneInsure Blog

Celebrating Insurance Awareness Day – History of Insurance Part II

In our previous post, we briefed you on the very early development of the insurance industry. In this piece, on the occasion of Insurance Awareness Day, we are going to explore further.

The Emergence of Varied Insurance Types

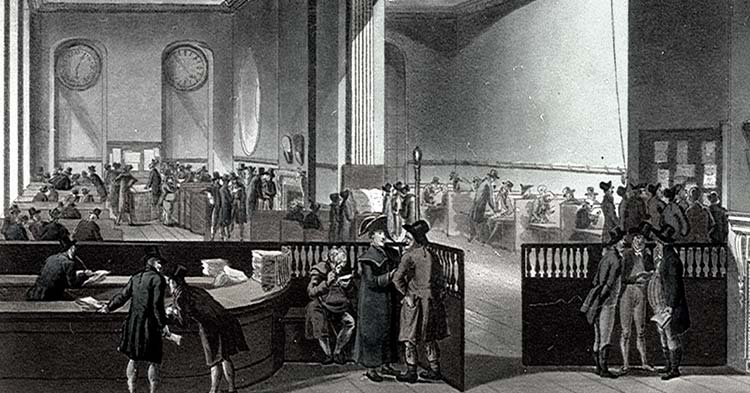

The early 18th century saw the distribution of the first life insurance policies by Amicable Society for a Perpetual Assurance Office. It was founded by William Talbot and Sir Thomas Allen in 1706 in London.

To combat the rising number of casualties in the early days of the railway system during the late 19th century, accident insurance was introduced.

The concept of health insurance first penetrated the nascent insurance industry in 1883 with Germany passing the mandatory health insurance law. The idea of mandatory insurance accelerated from there on and spread across a few other countries as the 20th century dawned. Gradually, some nations let the private sectors complement the government-led healthcare programs.

Insurance in India

Insurance in India, according to the writings of Yagnavalkya and Kautilya, dates back to ancient times. Fragments of these works indicate an ancient system that pooled resources and distributed them during catastrophic times such as floods, famine, fire, or epidemics. These roots eventually evolved after having borrowed from other countries, particularly England.

1818 marked the arrival of the life insurance business in the country,when the Oriental Life Insurance Company was established in the then capital of India, Calcutta. Gradually, the life insurance business flourished, with foreign insurance offices having an upper hand.

Post Independence, with unfair trade practices seeping into the industry, the newly-formed government resolved to nationalize the insurance business. Resultantly, LIC was established to subsume all existing Indian and foreign insurance companies operating in India into a single entity.

To further the benefits of the liberalisation policy initiated in 1991, the government reopened the doors for private insurers in the late 90s. Today, with about 24 Life and 31 General insurers, the Indian insurance industry is doing pretty well and is regulated by the Insurance Regulatory and Development Authority of India (IRDAI). Besides, from the premiums collected through varied insurance policies, the industry is assisting the Centre realize a number of development goals apart from helping thousands of households deal with financial emergencies.

Also Read: Insurance and How It Helps the National Economy

The Future

So how does the future of the insurance industry look?

With the advent of technology and digitization, the industry has achieved greater heights by going online. However, rapid growth brings its own challenges. For example, security has become a major concern and there’s higher potential for fraud and data misuse as many transactions are now taking place online. Nevertheless, tactful handling of this and other challenges is surely going to put the industry in a better and more reliable position in the coming years.

Comments

Comments

A brief history of Insurance, Insurance in India

A brief history of Insurance, Insurance in India