OneInsure Blog

History of Insurance – Introduction

Why do you carry an umbrella when you go out during monsoon even though it isn’t raining?

Because, although you’re not certain whether it will rain, you want to ensure that if at all it does, you have something to protect yourself with so you don’t get drenched.

Likewise, you buy insurance to protect yourself against the uncertainties of life. For example, you fall sick and get hospitalized, or you are driving on the road and a truck crashes into your vehicle, or you go to a foreign country for a trip and lose your passport when there. Apart from the physical and emotional stress that these events might bring upon you, there’s also the financial stress that they would put you in. But if you have insurance in place, you need not worry about those stresses.

So how does this thing called insurance work?

It’s simple. You pay a certain amount for a certain period in order to get a certain amount in return when an uninvited, uncertain event occurs. And it is this uncertainty of life for which the insurance companies undertake the risk in exchange for the premiums you pay. Insurance is the umbrella that you need to protect yourself and your family with against a financial crunch that an unforeseen event might bring. And if you don’t have this umbrella – watch it, there’s a good chance you will get drenched!

So, what are the types of risks that insurers cover you for?

Well, the insurance industry has grown far and wide (and we will discuss in brief its roots and development in the succeeding two blogs; links at the end of this blog). Today, you can get covered for pretty much anything. Besides getting covered for your life, health, and property, what many people don’t know is that you can also get covered for certain parts of your body, such as your fingers, hair, or even your butt. Shocked? Read our article Indian Celebrities and Their Unconventional Insurance Cover to explore some unusual insurance covers opted by celebrities across our country.

But then the basic types of insurance plans that you and I can opt for include:

- Life Insurance

- Health Insurance

- Critical Illness Insurance

- Motor Insurance

- Personal Accident Insurance

- Travel Insurance

- Home Insurance

- Business Insurance

- Pet Insurance

So, how does it all go down? How do you get the money back for expenses incurred?

Let’s help you understand by taking you through the entire working of an insurance policy.

Stage 1: You enter into an insurance contract

First of all, you let the insurer know your requirements and your premium-paying capacity, based on which the insurer will give you a list of suitable plans. Out of these plans, you select a plan that you think best meets your requirements and sign up for it.

Also Read: Don’t Lie to Your Insurer about Your Smoking Habits

Stage 2: You pay premiums regularly

After subscribing to a plan, you ought to pay your premiums regularly. You must note that non-payment of premiums will cause the policy to lapse and you will no longer be eligible to file a claim on your policy.

Stage 3: Something goes wrong and you have to file for a claim

Assume you are suffering from food poisoning and you had to be hospitalized while your health insurance policy is active. Now, first of all, let your insurer know that you have been hospitalized for so-and-so reasons. If you get hospitalized at one of your insurer’s network hospitals, then you may avail cashless medical treatment. If not, then you will have to pay for the expenses out of your own pocket first and then file for reimbursement from your insurer.

Stage 4: The insurer will investigate

Once you submit all the required documents along with the claim form, the insurer will look into your case, check if your claim is genuine, and that the situation you have incurred expenses on is covered under your policy. They will also cross-check and collect evidences (if required) to take a final decision.

Stage 5: Claim accepted or rejected?

After a thorough investigation, your insurer will get in touch with you and let you know whether your claim has been accepted or rejected. If your claim has been accepted, the money will be transferred to your account within the prescribed time limit. If not, they will inform you the reason/s for claim rejection.

And there you go! This is all you need to know about insurance if you’re looking to get yourself insured soon. However, on the occasion of Insurance Awareness Day, OneInsure would like to take you back to where it all began. So, sit back and relax as we take you through a brief history of insurance through two more of our blog posts:

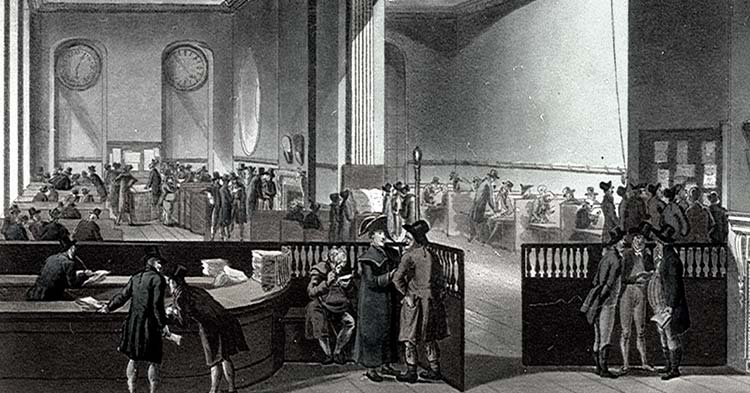

- Celebrating Insurance Awareness Day – A Brief History of Insurance Part I

- Celebrating Insurance Awareness Day – A Brief History of Insurance Part II

Comments

Comments

A brief history of Insurance, Insurance Industry

A brief history of Insurance, Insurance Industry