OneInsure Blog

How Much Life Cover Should I Have?

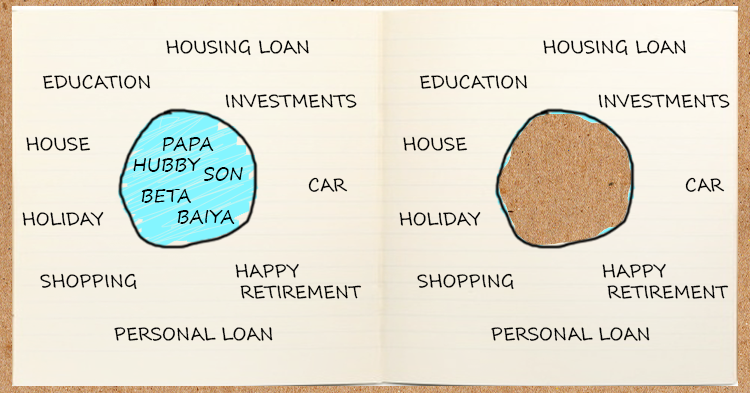

“How much life cover should I have?” is a question that we as an insurance broker are asked frequently by those seeking life insurance policies. Due to a number of factors, the required life cover of each individual may vary. In this article, we discuss these factors that will help you determine how much of the life cover you would require. Read on each factor below to figure out a rough amount of the sum assured that you should be looking for before settling for any life insurance plan.

1. Will it pay your outstanding liabilities?

Outstanding liabilities like your home or car loan will have to be paid even if something untoward happens to you. Besides that, you might have other pending liabilities. Make a list of all these liabilities and calculate to ascertain your total outstanding liabilities which need to be paid no matter what.

2. Will it pay your child’s education fees?

If you’re the sole earning member in the family, then your child’s financial future depends on you. In case of your unfortunate demise, your child shouldn’t be deprived of the education that s/he must have. Calculate a probable amount for the same based on the degree and college you wish to enroll him/her for. A good 4-year engineering course that costs about ₹8-10 lakhs today will cost at least ₹17-18 lakhs by 2025. By 2030, it will easily cross ₹30 lakhs and by 2040, ₹50 lakhs. So keep this in mind.

3. Will it replace the income that you earn?

Your current income also provides for your family’s monthly expenses (household, medical, travel, grocery, etc.) which might be disturbed followed by an unfortunate incident or your retirement. Let’s say, your family’s current monthly expenses are ₹15,000. In the future, this might increase due to rising costs and improvement in the standard of living. So estimate an annual amount that you might require to meet the basic expenses of the family.

4. Will it take care of your post-retirement plans?

If you’re looking for a retirement cum life insurance plan, then it will not only provide you a death benefit (in case of an untimely demise), but also a maturity benefit (in case you outlive the policy term). That means, if you survive, you get a lump sum amount from the insurance policy. You can use this amount to fulfill your retirement goals like getting your children married, sustaining your current standard of living, owning a property, going on foreign trips, etc. Ascertain how much money you’ll require to attain these goals.

Once done, count all these figures to estimate a final amount that you will need as your life cover. Now look for the Retirement Plans online and subscribe to a plan that you think is affordable (for this, you must consider the premium amount that you shall be liable to pay every month/year) and is close to the estimated amount that you’ve calculated to meet your retirement goals.

In case you need further guidance, let us know in the comment section below or get in touch with us at 86559 86559 or at support@oneinsure.com. Based on your requirements, our team of financial experts at OneInsure will help you decide which plan to go with.

Comments

Comments

Life Insurance Cover, Required Life Cover

Life Insurance Cover, Required Life Cover