OneInsure Blog

How to Financially Secure Your Child's Future

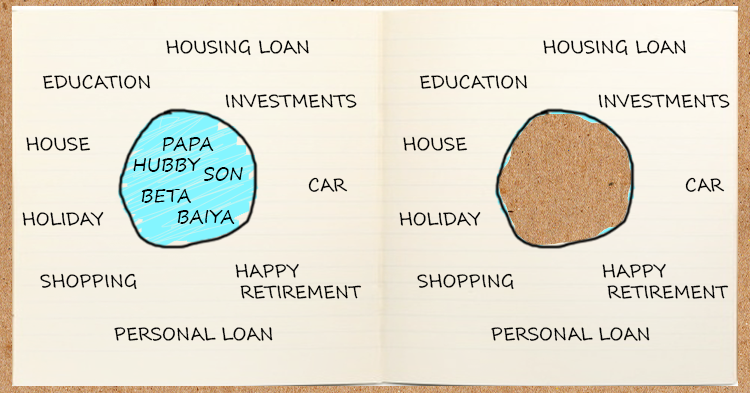

The primary concern for parents everywhere is ensuring their kids have a secure and better tomorrow. This involves being able to give them the necessary financial support during all the major milestones of their lives – school, college, marriage, and so on. Investing in a child insurance plan is therefore recommended as it serves the dual purpose of investment and insurance for your child. A child insurance plan ensures a secure future for your little one.

How Do Child Insurance Plans Work?

In the event of the demise of the parent, the insurance provider pays a lump sum amount (the sum assured) for the child’s benefit. If the plan comes with the waiver of premium feature, the insurance provider takes care of the future premiums such that the planned corpus gets accumulated and the child’s future is secured. These plans create a fund of the desired amount, which can be drawn upon at regular intervals to cater to different needs of the child, like education, marriage, and so on.

Nearly all life insurance companies offer child plans in their portfolio. Some are market-linked policies, allowing policyholders to choose between investing in debt or equities, and others are traditional plans that invest only in debt. Under Section 80(C) of the Income Tax Act, tax deductions can be claimed for the premiums paid towards this policy, and the proceeds received are tax-free under Section 10(10D).

Looking to avail a child insurance plan to secure the future of your little one? Write to us

Comments

Comments

Child Plans, child education plans, Life Insurance

Child Plans, child education plans, Life Insurance