OneInsure Blog

Seeking Car Insurance? Here’s Your Quick Guide

You think buying or renewing your car insurance is not your priority because you believe you’re a safe driver. But can you trust all others driving on the road? Or can you trust the weather that has its own mood swings and has the potential to thrust and crash even the giant trucks? Recent reports will make you think again. 2016 witnessed 20% rise in road accidents in India. Drunk and reckless driving, rains, fog and of course the potholes on roads should have an honorable mention when listing down the major reasons of road accidents in India. Without a valid car insurance policy, do you think you can tackle a sudden financial loss caused by these events? These things are beyond an individual’s control. We cannot predict the damage caused by them; however, we have the option of gearing up for the worst by simply buying ourselves a car insurance policy.

However, buying a car insurance plan can be a daunting task and you need to consider numerous aspects in order to narrow down to the best of the plans. Allow us then to introduce to you some of the basic but very important concepts of car insurance.

So, we come across many questions from our clients, and others who seek car insurance. In this article, we will make an attempt to answer those questions in a logical order. Here we go.

What is car insurance?

To put it simply, car insurance is a contract between you and the insurance company whereby you pay a certain premium every year and the insurer in return takes up the liability of paying the covered losses and damages to your car in the event of unforeseen instances.

Which are the losses and damages covered under car insurance?

The coverage is usually provided for the losses and damages in the following events:

- Personal accident cover

- Coverage for the loss or damage caused to your car by accident, fire, theft, and natural calamities

- Coverage against the financial liability on account of injury or death of a third party in case of an accident

- Coverage against the damage caused to the third party's property

Watch Out: Of course, ultimately it depends on what sort of plan you have. You cannot expect to be covered for the damage of your own car if you have only third party liability coverage. That’s why more often than not; it is advisable and sensible to get a comprehensive coverage. We have explained the types of coverage in the next question.

What are the types of car insurance?

Basically there are 2 types of car insurance:

- Third Party Liability Coverage –Motor Vehicles Act of India has made the third party liability coverage obligatory for any individual who buys a car (or two-wheeler for that matter). Under third party liability coverage, any sort of loss or damage caused to the third party, whether bodily injuries or damage to the property, on account of the accident met by the insurer’s car will be covered.

- Comprehensive Coverage – Here, the insurer covers you for three things:

- Third Party Liability – As discussed earlier, in case of an accident if there’s any loss or damage caused to the third party, it shall be covered under the plan. These include:

- Bodily injury or death of the third party

- Damage to the property of the third party

- Death of the insured vehicle owner

- Death of the driver of the insured (optional by paying a higher premium)

- Death of the other passengers in the Insured person’s car (optional by paying a higher premium)

- Permanent Total Disability of the insured vehicle owner, driver or passengers in the insured person’s car (optional by paying a higher premium)

- Own Damage – The losses and damages covered under Own Damage include:

- Damage caused due to accidents

- Natural Disasters: Storms, floods, tornadoes, hurricanes, earthquakes, etc.

- Fire, civil commotions and explosions

- Vandalism and theft

- Falling objects

- Terrorism

- Personal Accident Cover – In case of fatal accident, personal accident cover under comprehensive car insurance comes as a relief. It covers for:

- Death of the insured person

- Loss of two limbs or sight of two eyes or one limb or sight of one eye

- Permanent disability from injuries other than discussed above

- Third Party Liability – As discussed earlier, in case of an accident if there’s any loss or damage caused to the third party, it shall be covered under the plan. These include:

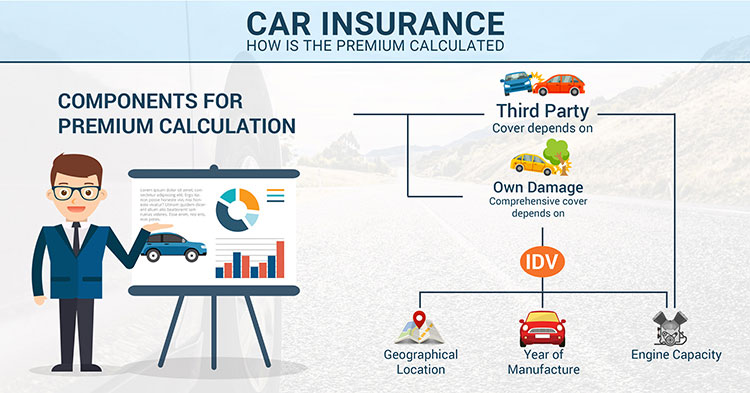

How is the premium on car insurance determined?

Premium on car insurance is determined on the following factors:

- IDV (Insured’s Declared Value) – IDV is basically the current value of the vehicle. It is also the maximum Sum Assured provided by the insurer in the event of any loss or damage to the vehicle. The lower the IDV, the lower the premium and vice-versa, hence, we may be tempted to declare a lower IDV with an objective to pay lower premium. However, in the event of total loss claim and theft, this may backfire and may not provide adequate coverage. So, always declare the correct IDV.

- Age of vehicle – The older your car is, the higher will be your premium as risk of accidents with the older vehicles elevates.

- Vehicle Registration Location – The city or town where your vehicle is registered is another factor that determines your premium. If your vehicle is registered in a metropolitan city like Mumbai, Bangalore, Delhi, Kolkata, Ahmedabad, Pune, etc., your premium will be comparatively higher when compared to other cities.

- Cubic Capacity – Your car’s engine’s capacity is determined on its cubic capacity (CC) and that determines your car’s premium. Cubic capacity has direct effect on the premium, so if the CC is high the premium will also be high and vice versa. The Indian Motor Tariff Act has specified TPPD premium as per the cubic capacity of the vehicle and this is calculated under liability clause.

Based on the cubic capacity of your car’s engine, premium calculations are separated into 3 categories:

- Less than 1000 cubic capacity

- Between 1000-1500 cubic capacity

- Above 1500 cubic capacity

These are the four main factors that directly influence your premium amount. Besides these, No-Claim-Bonus is another factor because of which your premium amount can fluctuate. We have explained no-claim-bonus in detail in the next question.

What is No Claim Bonus under car insurance?

Are you worried that you will have to keep paying the premium even if you do not make any claim in a year? Well, the insurance companies have a provision for that. For every claim free year, you will receive a discount on your premium in the subsequent years. Let’s say if you do not make any claim in the current year then next year you’re eligible for 20% discount on your premium. The percentage of discount cumulates with uninterrupted claim free years. To put it simply, in the earlier example let’s say you do not make claim the next year as well then you’re eligible for 25% discount on premium in the subsequent year. The maximum percent of discount that you can avail in the event of uninterrupted claim free years is 50%.

However, once you make a claim, you will lose your no claim bonus benefit. And in the event of your next claim free year, the subsequent year will start with 20% discount on premium.

This is probably one of the best features under car insurance because it encourages drivers to drive safely.

How to purchase car insurance?

Buying car insurance policy online is the easiest and quickest method. Here are some of the Best Car Insurance Plans available online.

For any further assistance or queries regarding car insurance, feel free to reach out to us at support@oneinsure.com. We have a team of experts to dispense unbiased advice to help you select the most suitable plan for your prized possession.

Comments

Comments

Car Insurance Plans, Car Insurance, TPL

Car Insurance Plans, Car Insurance, TPL