OneInsure Blog

What Is Whole Life Insurance And How Does It Work?

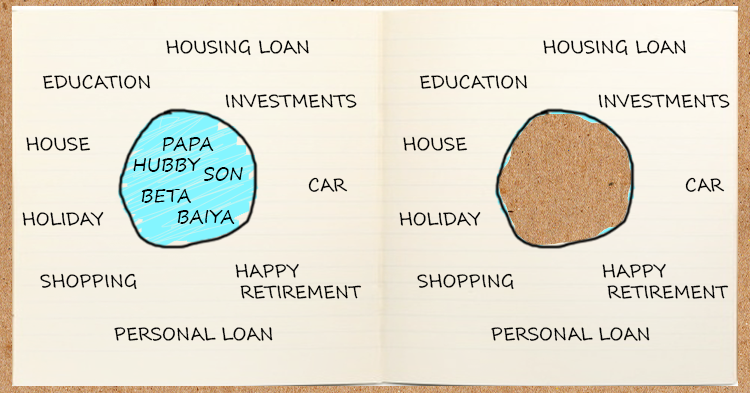

Whole life insurance is a type of life insurance product that covers you for your entire life. As long as premium payments are made on time and in full, the coverage lasts and you can be assured that death benefits will be paid. Premiums on such plans can be paid in one-off sum or on a regular basis. Whole life insurance plans are different from other kind of life insurance products - you will be covered till the age of 99 and if you outlive the policy term, you will receive the maturity beneits. Whole life plans can be with or without profit. Participating plans have a bonus factor, whereas non-participating plans do not pay out any bonus.

Whole life policies carry both insurance and investment components. Under the the insurance component, the life insurer pays a fixed amount to the nominees when the policyholder passes away. Under the investment component, an accumulated cash value is built from which the policyholder can withdraw or borrow against. Here, when premium payments are made, a portion of each premium accumulates as a cash value. You can avail loans against the cash value.

Premium rates of whole life policies

Insurance companies take a number of different factors into account while calculating the premium rates.

A smoker or drinker can expect to see higher premium rates as compared to those do not. Your gender also plays a role in determining the premium amount as women generally tend to live longer than men. Your family’s medical history is another matter of interest to insurers. If there are incidents of serious illnesses running in your family, insurers are likely to charge you higher rates. The other factors that impact your premium rates include - your age, occupation, health history and the policy itself.

Whole vs Term Insurance

Coming to the question of which life product to choose, it is important to note that both policies play very different roles. Term life covers you for a certain period of time, like 20 or 30 years, whereas whole life insures you for your entire life. In case of term plans, once the policy period ends, you generally do not receive any maturity benefits. However, for whole life covers you can be assured of that benefits will be paid out. You also benefit from the build up of cash value in whole life plans. Both the insurance policies vary greatly in features. Assess your needs and the benefits you require and accordingly decide which policy you would like to go ahead with.

Comments

Comments

Life Insurance

Life Insurance